When pushing for limiting how much you can deduct for state and local taxes on your federal income taxes, Republican lawmakers argued that such breaks were unfair because they subsidized the super rich -- especially in states like New Jersey.

But new statistics show the impact of the tax law signed by President Donald Trump hits far more New Jerseyans who make far less.

Most New Jersey households affected by the Republicans' $10,000 cap on the state and local tax deduction make $75,000 to $200,000 a year, new studies show.

That's 860,000 Jersey households in that income range whose average state and property tax deduction exceeded $10,000, according to Internal Revenue Service statistics.

And it was more than double the 326,260 taxpayers earning more than $200,000 who got the same tax break.

In raw dollars, upper-income taxpayers will lose more in tax breaks because their average deduction was $51,401, compared with less than $15,000 for those making under $200,000. But that's only part of the story.

"It's not just about the dollars, it's that more people in the middle class got affected," said U.S. Sen. Robert Menendez, D-N.J., a member of the tax-writing Senate Finance Committee.

The debate over the tax cut law signed by President Donald Trump was rekindled when House Republicans proposed making permanent those provisions in the initial law that were scheduled to expire in 2025. That included the cap on deductions.

The GOP tax plan, which already would increase the federal deficit by $1.9 trillion over 10 years, would add another $631 billion in red ink through 2027.

To fund federal income tax cuts, which affected most brackets, congressional Republicans targeted the state and local tax deduction. They claimed that it subsidizes high-tax states. In actuality, those states, which are mostly controlled by Democrats, subsidize Republican-led states to the tune of billions of dollars every year.

The bill funded a cut in the top tax rate, paid by those making at least $470,000, and a major reduction in the tax paid by multimillion-dollar estates, by going after a tax break primarily used by the middle class, primarily in high-tax localities.

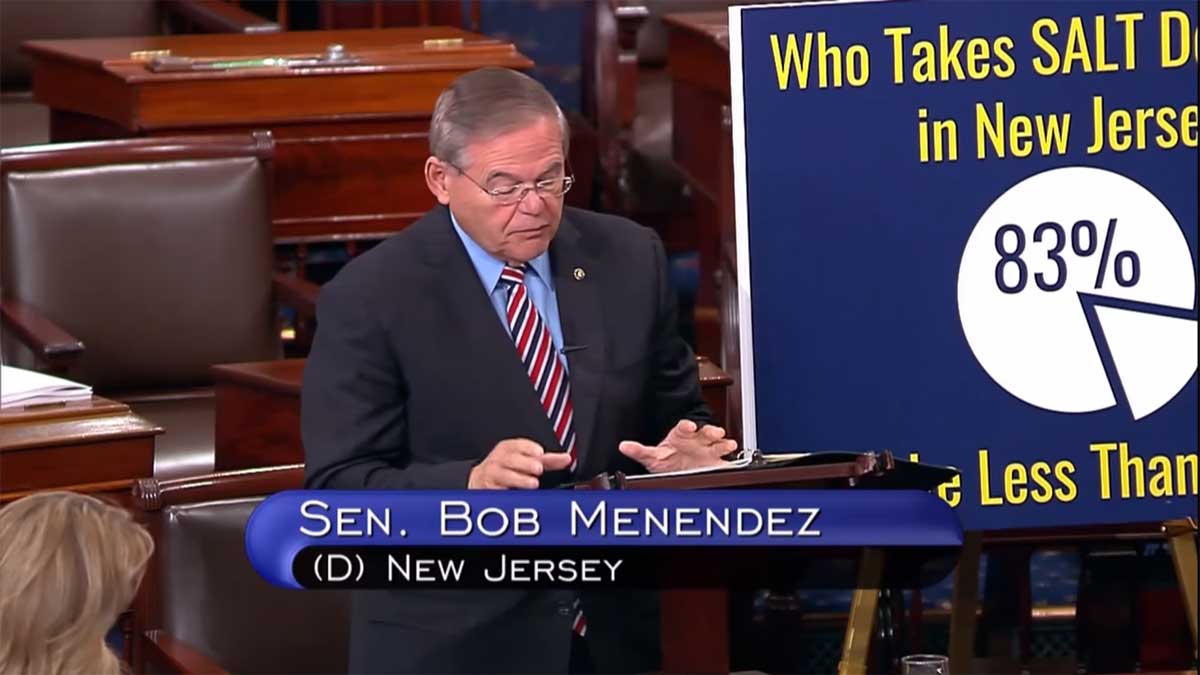

More than eight in 10 New Jersey taxpayers who used the state and local tax deduction earned less than $200,000, according to the IRS.

"These are people just trying to have enough money to keep up on mortgage payments, pay for the next family vacation, weather surprise medical costs, or afford college textbooks," said Rep. Bill Pascrell Jr., D-6th Dist., a member of the House Ways and Means Committee that voted last week to make the tax cuts permanent.

"And, importantly, this deduction allowed state and local governments to raise revenue for critical services without encroachment from the federal government," said Pascrell, whose amendment to keep the full deduction was defeated along party lines."

The reports also showed:

* One-quarter of those earning between $99,700 and $171,200 would see their taxes go up in 2026 if the GOP tax bill is made permanent, according to the Institute on Taxation and Economic Policy, a Washington-based research group. A total of 95 percent of those making more than $1.1 million would face a tax increase.

* Overall, 17 percent of residents of New Jersey and Maryland would pay more in taxes, a higher percentage than any other state, according to the ITEP report.

* Just removing the $10,000 cap on state and local property tax deductions would reduce taxes for 28 percent of New Jerseyans, second only to Maryland. That would mean a bigger cut for some taxpayers and cancel out a tax hike for others.

The current cap on the state and local tax deductions prompted state Senate President Stephen Sweeney, D-Gloucester, to oppose Gov. Phil Murphy's proposed millionaires' tax.

New Jersey Chamber of Commerce President Tom Bracken, who opposed the original bill and doesn't like the new version, said even fewer Garden State residents may wind up benefiting.

Under the current law, more than 1 in 10 New Jersey taxpayers would see a tax increase, the highest percentage in the nation, according to the Tax Policy Center, a Washington research group. Less than 62 percent would get a tax cut, a percentage lower than 45 other states.

"A lot of people are being given a tax burden that they weren't paying before," Bracken said. "The people who are going to pay a lot of this tax burden have not yet felt that impact. They're benefitting from lower deductions, the take home's higher, but they haven't paid the bill yet."

The Republican law and New Jersey's high taxes are being debated in a midterm seen as a referendum on Trump.

Sixty-two percent of campaign ads in New Jersey last month mentioned taxes, a higher percentage than any other state, according to the Wesleyan Media Project, which tracks political advertising.

In the Senate race, the tax issue could force Menendez's Republican opponent, Bob Hugin, to either promise to buck his party leaders or pave the way for them to permanently cap the state and local tax deduction.

That's because Republicans will need to use the same parliamentary maneuver as last year to allow them to pass their bill without needing 60 votes to overcome a Democratic filibuster.

Hugin spokesman Nick Iacovella said the candidate "would not support any effort" that permanently would cap the state and local taxes, which he said "unfairly targets New Jersey."

Hugin's campaign literature promises the candidate will "work with President Trump," who supports the cap.